Soil carbon credit markets are evolving beyond simple ton-per-hectare measurements into sophisticated risk assessment systems borrowed from unexpected sources. Just as 7games bet sportsbooks calculate odds on game outcomes by weighing countless variables, a new generation of carbon credit models is applying similar probability-based frameworks to predict which farming practices will genuinely sequester carbon over time—and which might fail.

For Alberta farmers considering carbon credit programs, this shift matters tremendously. Traditional verification methods often treat all enrolled acres equally, missing crucial differences in soil type, weather patterns, and management consistency that determine actual carbon storage. Odds-based modeling changes this equation by assigning probability scores to your specific operation, much like how oddsmakers evaluate team performance histories, player conditions, and environmental factors before setting betting lines.

This approach benefits producers in tangible ways. Instead of blanket rejection when one field underperforms, your overall operation receives credit weighted by success probability across all parcels. A quarter-section with heavy clay that reliably builds organic matter counts more favorably than marginal land with inconsistent results. Buyers gain confidence through transparent risk profiles, potentially commanding premium prices for high-probability credits from well-managed farms.

The methodology draws from financial risk modeling and actuarial science, but translates surprisingly well to agricultural realities. Saskatchewan pilot projects are already demonstrating how probability-weighted assessments reduce verification costs while improving accuracy. For Canadian farmers navigating carbon market complexity, understanding odds-based frameworks means better positioning your operation to capture emerging opportunities while contributing measurably to climate solutions. This article unpacks exactly how these models work and what they mean for your farm’s carbon strategy.

Why Carbon Credits Need Better Risk Models

The Real Cost of Carbon Credit Uncertainty

When soil carbon measurements don’t meet initial projections, the financial consequences hit farming operations hard. Consider the experience of a grain cooperative near Red Deer, Alberta, where 12 member farms enrolled in a carbon credit program in 2021. Initial soil tests suggested the group could generate 2,400 credits over three years. Two years in, actual measurements revealed only 1,100 credits would materialize—a 54% shortfall that translated to approximately $68,000 in lost anticipated revenue.

The impact extends beyond immediate income losses. Many farmers make upfront investments in new equipment, cover crops, or modified tillage practices specifically to participate in soil carbon markets. When credits fall short, these expenses become difficult to justify. A mixed farm operation near Lethbridge invested $22,000 in precision seeding equipment for a carbon program, only to abandon the initiative after year one when soil carbon gains measured 40% below projections.

Program abandonment creates another hidden cost: opportunity loss. Saskatchewan research shows that farms leaving carbon programs prematurely miss the compound benefits that typically emerge in years three through five. More concerning is the ripple effect—disappointed early adopters share their experiences, creating hesitation among neighbouring producers who might otherwise participate.

This uncertainty cycle undermines confidence in carbon programs altogether, even when the fundamental science remains sound. Without reliable risk assessment tools, farmers struggle to make informed decisions about whether these programs align with their operation’s financial reality.

Traditional Verification: Too Slow for Modern Markets

For Alberta farmers exploring carbon credit programs, traditional verification poses a significant barrier. The conventional approach requires physical soil sampling across multiple locations on your land, with samples sent to laboratories for carbon analysis. This process typically takes 6-8 weeks from initial sampling to receiving results, and that’s just for baseline measurements. Follow-up verification happens every 3-5 years, creating long gaps between assessments.

The financial burden is equally challenging. Laboratory analysis costs range from $50-150 per sample, and comprehensive field verification requires multiple samples per quarter section. When you factor in consultant fees and travel expenses, many Alberta producers face initial verification costs exceeding $3,000-5,000 per enrolled field.

Perhaps most frustrating is the uncertainty during waiting periods. You’ve implemented conservation practices like reduced tillage or cover cropping, but won’t know your carbon sequestration rates until results arrive months later. This delayed feedback makes it difficult to adjust management practices or confidently commit to multi-year carbon programs. For farmers operating on tight margins, these timelines and costs often make carbon credit participation financially impractical, despite genuine interest in sustainable practices and additional revenue streams.

What Sportsbooks Know That Agriculture Doesn’t

How Bookmakers Calculate Risk in Real-Time

Think about how a sportsbook prices a hockey game. They’re not just looking at one number—they’re pulling in team statistics, injury reports, weather conditions, recent performance trends, and even betting patterns from their customers. All this information gets processed continuously, and the odds shift in real-time as new data arrives or as more money comes in on one side.

This dynamic risk calculation works because bookmakers understand a fundamental truth: uncertainty isn’t something to avoid, it’s something to price accurately. When Connor McDavid gets injured minutes before puck drop, the odds change immediately. The bookmaker doesn’t panic—they have systems designed to absorb new information and recalculate risk instantly.

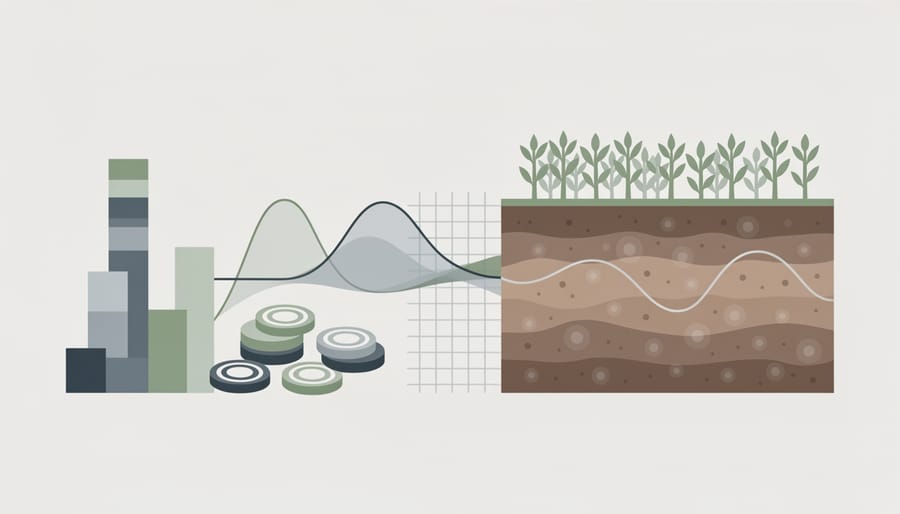

The exact same principles apply to soil carbon credit markets. Just as a sportsbook weighs multiple data streams, a carbon credit risk model aggregates soil tests, weather data, farming practices, historical yields, and remote sensing imagery. Each data point contributes to the overall risk assessment.

Here’s where it gets practical for Alberta farmers: instead of a simple pass-fail verification system, an odds-based model could evaluate your carbon project on a continuous scale. Had a dry spring that might affect carbon sequestration? The model adjusts your risk profile—and therefore your credit value—proportionally, rather than disqualifying you entirely.

Dennis Lewchuk, an agronomist working with southern Alberta producers, explains: “Farmers already manage weather risk, market risk, and input cost risk. Carbon credit risk isn’t fundamentally different. What matters is having transparent, fair pricing that reflects your actual management practices rather than crude averages.”

The bookmaker approach means faster decisions, more nuanced pricing, and recognition of the real-world variability every farming operation faces. Instead of waiting months for verification, automated systems could provide near-instant risk assessments based on your submitted data.

The Power of Continuous Data Updates

One of the most exciting aspects of odds-based modeling is how it responds to new information in real-time. Think about how betting odds shift during a hockey game as goals are scored or penalties called. The same principle applies to soil carbon monitoring throughout the growing season.

Rather than relying solely on annual soil tests, this approach allows you to update risk assessments as fresh data arrives. When you take a mid-season soil sample, measure crop biomass, or record tillage events, the model recalculates the odds of meeting your sequestration targets. A dry spring that slows plant growth would shift odds downward, while a season of optimal moisture and robust cover crop establishment would improve them.

For Alberta farmers, this means more responsive decision-making. If July monitoring shows your odds dropping below comfortable levels, you still have time to adjust management practices like adding supplemental amendments or modifying fall tillage plans. Instead of discovering problems months after the fact, you can course-correct while it matters.

This continuous feedback loop transforms carbon credit programs from static annual assessments into dynamic partnerships between farmers and their land, building confidence through transparency and timely information.

Odds-Based Risk Modeling for Soil Carbon Credits

From Game Outcomes to Carbon Outcomes

The beauty of this approach lies in its elegant simplicity. Just as a sportsbook analyzes team statistics, player performance, and field conditions to predict game outcomes, odds-based carbon modeling evaluates farm-specific variables to forecast your likelihood of hitting carbon sequestration targets.

Instead of asking “Will the Flames win tonight?”, the model asks “Will this field sequester 0.5 tonnes of carbon per hectare this season?” The answer depends on your unique data: soil type, historical management practices, current tillage approach, crop rotation patterns, precipitation levels, and even your implementation track record with conservation practices.

Consider a typical Alberta grain farm transitioning to reduced tillage. Traditional carbon credit programs might offer a fixed rate per hectare, regardless of whether your heavy clay soils respond differently than your neighbour’s loam. An odds-based model, however, assigns probability scores to different sequestration outcomes based on your specific conditions. Perhaps your farm shows an 85 percent probability of achieving baseline targets but only a 40 percent probability of reaching premium sequestration levels, while your neighbour’s probabilities run opposite.

This precision transforms how you approach carbon credit opportunities. Rather than guessing whether participation makes financial sense, you receive clear probability assessments tied to realistic outcomes for your operation. The model might indicate that implementing cover crops alongside your current no-till practices would shift your odds from 60 percent to 80 percent for hitting higher-value credit tiers.

Think of it as moving from generic betting odds to personalized predictions calibrated specifically for your farm’s conditions, history, and management style.

Key Data Inputs That Drive the Model

The beauty of odds-based soil carbon risk modeling is that it relies on information most Alberta farmers already track for daily operations. You don’t need expensive equipment or specialized consultants to get started—just systematic record-keeping and awareness of what matters most.

Your soil test results form the foundation. Most producers already test for pH, organic matter content, and nutrient levels every few years. These baseline measurements establish your starting carbon levels and texture classifications (clay, loam, sand), which directly affect carbon storage potential. If you haven’t tested recently, provincial programs through Alberta Agriculture often subsidize soil analysis.

Weather data creates the context for carbon outcomes. Precipitation totals, temperature ranges, and frost dates all influence microbial activity and plant growth. The good news? Environment Canada provides free historical climate data for your region, and many farms now have on-site weather stations collecting real-time information.

Management practice records are your operation’s unique story. Track tillage frequency and intensity, crop rotations, cover crop usage, fertilizer applications, and manure incorporation. These practices dramatically affect carbon accumulation rates. Even basic field notes in a spreadsheet work perfectly—date, activity, and location create valuable patterns over time.

Historical yield data demonstrates productivity trends that correlate with soil health improvements. Most farmers maintain yield records for crop insurance purposes, making this information readily accessible.

Land topography and drainage characteristics round out the picture. Slope percentages, wetland areas, and irrigation systems influence moisture retention and erosion risk—both critical factors in carbon stability.

The key is consistency. Regular documentation transforms scattered information into predictive power, helping risk models accurately assess your carbon credit reliability without complicated measurements or external dependencies.

What This Means for Your Farm Operation

Better Price Negotiations and Planning

Understanding your carbon credit odds fundamentally changes how you approach contracts and practice adoption decisions. Instead of accepting standard contract terms that treat all farms identically, odds-based modeling gives you specific data about your farm’s likelihood of generating verified credits. This knowledge becomes powerful leverage in negotiations.

Consider a practical example from central Alberta: Two grain farmers both considering cover cropping received vastly different odds profiles. One farm with clay-loam soils and higher organic matter showed 75% probability of meeting verification thresholds, while another with sandier soils showed 45%. Armed with these numbers, the first farmer successfully negotiated a higher advance payment per enrolled hectare, knowing their risk profile justified better terms. The second farmer made an equally smart choice, deciding to focus on practices with better odds on their specific land rather than committing to a program unlikely to pay off.

This approach also helps you prioritize which practices make financial sense. If installing riparian buffers shows 80% odds of credit generation on your property while no-till shows 50%, you can allocate limited capital toward the higher-probability practice first. You’re no longer guessing or following what worked for your neighbour.

The real value lies in planning confidence. When you know your odds before signing multi-year agreements, you can make enrollment decisions that align with your operation’s actual capacity to deliver verified credits, reducing disappointment and maximizing returns from your conservation investments.

Reduced Verification Costs

Traditional soil carbon verification can cost between $40 to $80 per sample, and with recommendations suggesting multiple samples per field, expenses add up quickly for Alberta farmers. Odds-based modeling offers a practical middle ground that maintains buyer confidence while significantly reducing testing frequency.

By using predictive algorithms trained on existing soil data, weather patterns, and management practices, these models can estimate carbon sequestration likelihood across your entire operation. Instead of testing every field annually, you might verify just 15-20% of your acreage while the model fills in the gaps with statistically reliable predictions. This approach mirrors how agronomists use soil zone mapping—testing representative areas and extrapolating results.

John Peterson, a carbon credit consultant working with southern Alberta producers, explains: “We’ve seen verification costs drop by 60% when farms adopt odds-based modeling, but credit buyers still trust the data because the statistical foundation is sound.”

The key is building credibility through strategic sampling. Initial baseline testing remains important, but ongoing verification becomes targeted and efficient. For a 1,000-hectare operation, this could mean saving $30,000 to $50,000 over a five-year contract period—money that stays in your pocket while you continue earning carbon revenue.

Insurance and Financial Products

Odds-based risk modeling is opening doors to financial products that were previously out of reach for many Canadian farmers. Insurance companies are now developing carbon credit insurance policies that protect farmers against verification failures or market volatility. These products use probability assessments similar to those used in profiting from soil carbon credits to set premiums fairly based on your specific farm conditions. Banks and agricultural lenders are also beginning to offer financing options secured against projected carbon credit revenues. For Alberta producers, this means you might access operating loans or equipment financing backed by your soil carbon potential. Several Saskatchewan farmers have already secured bridge financing for conservation equipment purchases using carbon credit projections as collateral. These financial tools reduce the upfront risk of transitioning to carbon-friendly practices, making sustainable farming more accessible to operations of all sizes.

Real-World Applications in Canadian Agriculture

Early Adopters and Pilot Programs

Several Alberta producers are already exploring odds-based approaches to carbon credit risk assessment, though formal programs remain in early stages. The Vermilion River County Agricultural Service Board recently partnered with three local cattle operations to test preliminary risk modeling based on field variability data. According to agronomist Sarah Chen, who’s consulting on the project, “Instead of treating all 400 hectares the same, we’re mapping confidence levels field by field. It’s like saying ‘this quarter has 80% odds of hitting our carbon targets, while that one’s closer to 60%.'”

Prairie Futures Co-operative in Red Deer launched a small pilot this spring with twelve mixed farms implementing regenerative grazing methods. They’re tracking which practices show the most predictable carbon outcomes. Manager Tom Blackwell explains, “Farmers want to know their actual chances of success before committing resources. This approach gives them that visibility.”

The University of Alberta’s Department of Renewable Resources is collaborating with fifteen farms across central Alberta to refine odds-based modeling tools. Dr. James Peterson notes that early participants appreciate the honest assessment: “Producers tell us they’d rather know upfront that certain fields have lower probability than discover shortfalls at verification time.”

These pilot initiatives suggest growing interest in more transparent, probability-based risk assessment among Canadian agricultural communities seeking reliable carbon market participation.

Technology Partners Making It Happen

Several innovative companies are pioneering odds-based carbon modeling specifically for Canadian agriculture. Nori, a carbon removal marketplace, has integrated dynamic risk assessment into their verification process, allowing Alberta grain farmers to see real-time probability scores for their soil carbon projects. Their platform now incorporates weather data and regional soil variability to calculate project success odds before farmers commit resources.

Canadian agtech firm CarbonLink has developed partnerships with provincial soil testing labs to build localized risk models. Their system uses historical data from over 2,000 Prairie farms to generate odds that reflect regional conditions, from Lethbridge’s chinook winds to Peace Country’s shorter growing seasons.

Regrow Ag offers a monitoring platform that combines satellite imagery with ground-truthing to provide ongoing probability updates throughout the growing season. This helps farmers in central Alberta adjust management practices when carbon sequestration odds shift due to drought or excessive moisture.

For farmers exploring these technologies, start by requesting demonstrations that show how odds calculations work with your specific soil type and climate zone. Ask providers about their data sources and whether their models include Canadian-specific agricultural practices and environmental factors.

Getting Started: What Farmers Need to Know

Questions to Ask Program Providers

Before committing to a carbon credit program using odds-based risk modeling, protect your interests by asking these essential questions:

How do you calculate my farm’s baseline risk score? Request a clear explanation of which factors influence your rating, from soil type to weather patterns. Understanding this helps you identify areas where you can improve your odds.

What percentage of credits do you withhold for risk? Some programs may hold back 20-30% of your credits as a buffer. Know upfront how this affects your potential revenue compared to the real costs of carbon storage on your operation.

Can I see the data supporting your risk predictions? Transparency matters. Ask if their model has been validated using Canadian farms, particularly in conditions similar to yours.

How often will you reassess my risk profile? Your management improvements should lower your risk score over time, potentially increasing your credit allocation.

What happens if I outperform expectations? Some programs offer bonuses when farms exceed projected sequestration rates—a fair incentive for excellent stewardship.

Who verifies the modeling accuracy? Independent third-party validation adds credibility and protects your interests in long-term contracts.

Preparing Your Farm Data

Start by establishing a baseline. Document your current soil management practices, including tillage methods, crop rotations, cover crop use, and fertilizer applications over the past three to five years. The more detailed your records, the stronger your position when demonstrating actual practice changes.

Next, collect existing soil tests and field maps. If you haven’t conducted soil sampling recently, now is the time. Focus on organic matter content, bulk density, and soil texture across representative areas of your farm. Many Alberta producers find it helpful to sample in a grid pattern at depths of 0-15 cm and 15-30 cm to capture carbon changes in different soil layers.

Organize records of weather patterns, yield data, and any conservation practices you’ve implemented. Photos documenting field conditions throughout seasons can provide valuable visual evidence of changes over time.

Consider partnering with your agronomist or conservation district to ensure your data collection methods align with emerging verification standards. Some Alberta farmers are already working with local agricultural extension offices to set up simple spreadsheet systems that track this information efficiently. The key is consistency—even basic records maintained year over year become powerful evidence of your farm’s carbon story and help risk assessors calculate more favorable odds for your operation.

Odds-based soil carbon credit risk modeling represents a meaningful evolution in how we value and verify carbon sequestration efforts on Canadian farms. This approach brings much-needed transparency to carbon markets, helping farmers like you understand not just what credits are worth, but why they’re priced that way. Instead of operating in uncertainty, you gain access to clear, data-driven assessments that reflect the real conditions of your operation.

For Alberta producers and farmers across the Prairies, this methodology offers practical advantages. Better risk assessment translates directly into fairer pricing for your carbon credits. When verifiers and buyers can accurately evaluate your farm’s sequestration potential using odds ratios and probability models, you’re less likely to be undervalued or face unexpected verification challenges. This means more predictable revenue streams and reduced administrative headaches when participating in carbon programs.

The agricultural sector is moving toward increasingly sophisticated sustainability tools, and staying informed about these developments positions you to make strategic decisions. Consider how odds-based modeling might align with your operation’s goals, whether you’re already enrolled in carbon programs or exploring opportunities. Talk with your agronomist, connect with other producers who’ve participated in carbon markets, and evaluate whether this transparent, risk-adjusted approach makes sense for your land and long-term plans.

As carbon markets mature, methodologies that bring clarity and fairness will become standard practice. Understanding these tools now gives you a competitive advantage and helps build resilient, sustainable operations that thrive in tomorrow’s agricultural landscape.